Upbhulekh Bank Login

In recent years, India has made substantial strides in digitizing services across various sectors to enhance accessibility and streamline administrative processes. One such area of digital transformation is land record management, and “Upbhulekh” plays a central role in this modernization. “Upbhulekh” is a government initiative, primarily utilized in Uttar Pradesh, to facilitate citizens’ access to land records and other related services online. When discussing “Upbhulekh Bank Login,” we refer to the procedure by which users, particularly banks and financial institutions, can access land records and property details for various financial and verification processes.

In this article, we’ll delve into the Upbhulekh platform, how the bank login works, its significance, and how it benefits both citizens and banking institutions. Let’s explore how this system is helping streamline financial operations and property transactions in India.

What is Upbhulekh?

Upbhulekh, or “Uttar Pradesh Bhulekh,” is an online platform established by the government of Uttar Pradesh to digitize land records in the state. The term “Bhulekh” is derived from two Hindi words: “Bhu” meaning “land” and “Lekh” meaning “records.” Therefore, Upbhulekh is essentially a digital database of land records that enables citizens and authorized institutions to access information regarding land ownership, property details, land maps, and other essential data related to land in Uttar Pradesh.

The platform is not only convenient for individual citizens but also serves as a critical tool for banks, financial institutions, and other authorized entities that need to access land records for property verification, loan approvals, and due diligence processes. This digitized record management system helps maintain transparency, reduce fraud, and facilitate faster administrative processes.

Key Features of Upbhulekh

- Digital Access to Land Records: Upbhulekh offers comprehensive access to various land records, including ownership status, property boundaries, and land classifications. This digital access is available to citizens and authorized entities, including banks.

- Property Verification for Financial Institutions: Banks can verify property ownership and related records before granting loans or mortgages. This verification step is essential to avoid issues related to disputed or illegally encumbered properties.

- Historical Records: The Upbhulekh system allows users to view the historical ownership of a property, which helps in understanding past transactions and land disputes, if any.

- Land Map Access: Upbhulekh also provides access to land maps, helping individuals and banks understand the physical layout and positioning of the land. This feature aids in boundary verification and survey processes.

- Security: Authorized access for banks through a secure login system ensures that only legitimate financial institutions can access sensitive property information. This layer of security prevents misuse of land record data.

The Importance of Upbhulekh Bank Login

For financial institutions, having access to an accurate database of land records is invaluable. With the Upbhulekh Bank Login system, banks can swiftly access essential property information to facilitate processes such as:

- Loan Approvals: When a person applies for a loan, especially a mortgage or agricultural loan, the bank must verify the ownership of the property offered as collateral. Through Upbhulekh, banks can ascertain the ownership and status of the property, making the loan approval process faster and more reliable.

- Fraud Prevention: One of the most significant challenges banks face is verifying the authenticity of property-related documents submitted by loan applicants. By using the Upbhulekh platform, banks can directly access government-maintained records, thus reducing the risk of document forgery and fraudulent claims.

- Credit Risk Assessment: Access to accurate land records allows banks to assess the creditworthiness of applicants better. If a property is already pledged as collateral, banks can make an informed decision on whether to grant additional loans.

- Ease of Verification: Traditional verification processes were time-consuming, often requiring physical visits to local land records offices. With Upbhulekh Bank Login, this information is available at the click of a button, saving time and resources.

How to Use Upbhulekh Bank Login

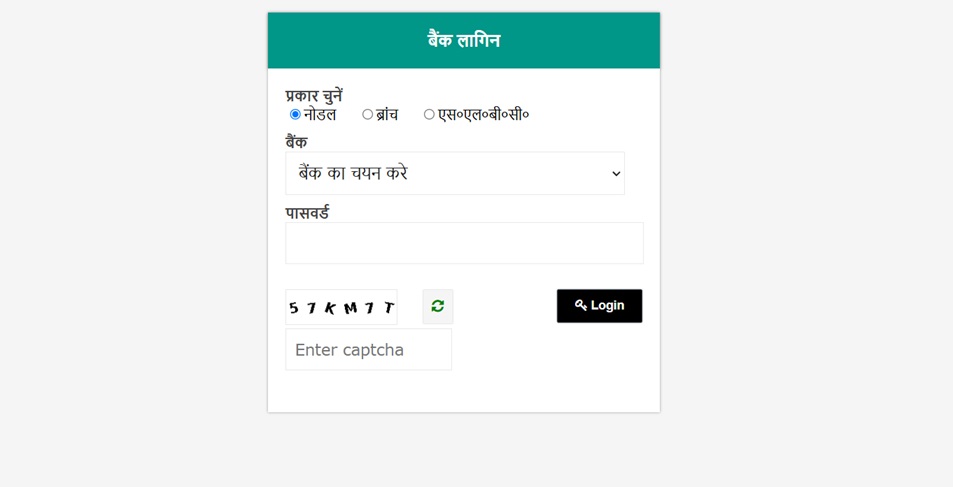

Accessing Upbhulekh as a banking institution requires adherence to the platform’s login procedures and security measures. Here’s a step-by-step guide for banks to log in and access land records:

- Visit the Official Upbhulekh Website: Banks and financial institutions need to navigate to the official Upbhulekh portal of Uttar Pradesh. This platform is accessible via the website: upbhulekh.gov.in.

- Locate the Bank Login Option: On the homepage, look for the “Bank Login” section. This option is typically reserved for registered banking institutions that have authorization to access land records.

- Enter Credentials: Authorized bank personnel can enter their login credentials (user ID and password) provided by the government. These credentials are issued upon official registration and verification with the relevant authorities.

- Access Land Records: Once logged in, banks can search for property details by entering details such as the owner’s name, land record number, or district and village information. This search will yield results on ownership, property type, and other relevant details.

- Download and Save Records: Banks may download copies of land records or relevant documents for their records. However, these documents are typically for internal use only and are kept secure to protect the privacy of landowners.

Benefits of Upbhulekh for Banks and Financial Institutions

The integration of digital land records through Upbhulekh provides multiple advantages to banks and financial institutions:

- Streamlined Loan Processing: The traditional method of property verification was slow and involved extensive paperwork. Upbhulekh simplifies this by offering instant digital access to property records, making the loan processing quicker and more efficient.

- Increased Transparency: Upbhulekh offers transparency by allowing banks to cross-verify information. This transparency helps build trust among customers, who can be assured that banks are using government-verified data.

- Enhanced Security: The Upbhulekh platform is secure and accessible only to authorized individuals. Banks can rely on the accuracy of these records without worrying about tampered or forged documents, as they’re directly sourced from government records.

- Reduction in Operational Costs: By minimizing the need for physical document handling and manual verification processes, banks can reduce their operational costs. Digital access to records reduces dependency on physical offices and administrative manpower, thus increasing cost-efficiency.

- Risk Mitigation: With Upbhulekh, banks are able to evaluate the risks associated with properties, such as encumbrances or legal disputes. This proactive approach helps banks mitigate potential financial losses from disputed properties.

Potential Challenges and Solutions

While Upbhulekh offers significant benefits, there are challenges associated with the platform, especially for financial institutions:

- Limited Access in Some Regions: Although the platform is accessible in Uttar Pradesh, similar systems may not be available in other states, which can limit cross-state operations for banks. Solution: Encouraging other states to adopt similar systems would create a nationwide database.

- Internet Access and Connectivity Issues: In rural areas, lack of high-speed internet can hamper access. Solution: Offline access mechanisms or dedicated apps could make the platform more accessible in low-connectivity areas.

- Security Concerns: Even though Upbhulekh is secure, there is always a risk of cyber threats. Solution: Regular updates and enhanced security protocols could safeguard data integrity.

Conclusion

The Upbhulekh Bank Login system has revolutionized how banks and financial institutions handle property-related transactions in Uttar Pradesh. By facilitating seamless access to land records, Upbhulekh accelerates loan processing, reduces fraud, and ensures transparency in financial dealings. As India continues to embrace digital transformation, the Upbhulekh model could serve as a benchmark for other states, ultimately leading to a unified, nationwide digital land record management system.

For both citizens and financial institutions, Upbhulekh exemplifies how technology can be leveraged to simplify complex processes and improve service efficiency. As the platform evolves, it is expected to play an even more critical role in India’s financial and administrative landscape, making property management and verification more reliable, secure, and accessible.