porinju veliyath net worth

Introduction to Porinju Veliyath Net Worth

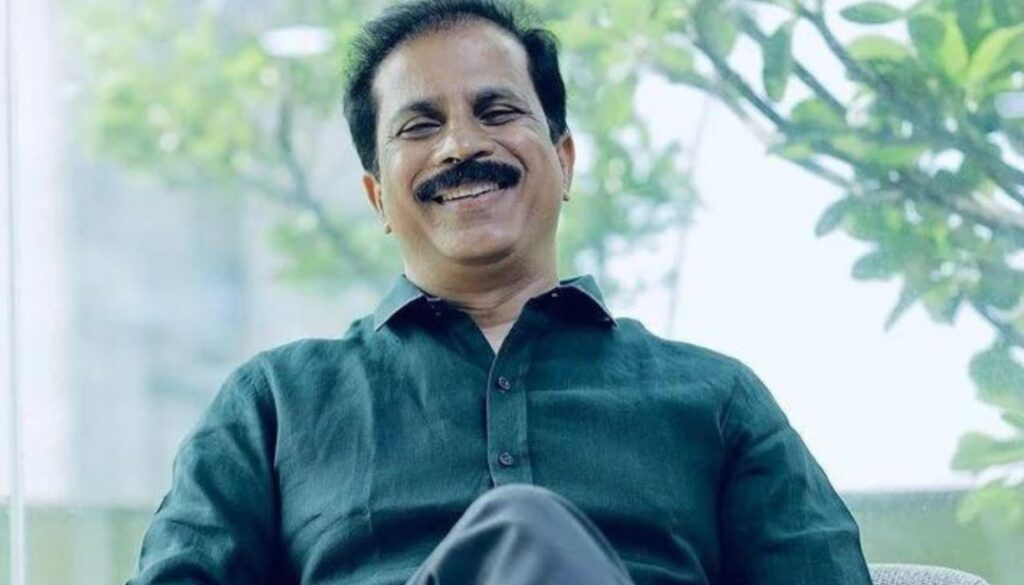

Porinju Veliyath is a name that resonates with passion, perseverance, and extraordinary success in the world of Indian stock markets. Widely regarded as the “Small-Cap Wizard,” Porinju’s investment strategies and business acumen have propelled him to great heights, making him one of the most respected figures in India’s financial landscape. From humble beginnings to managing one of the country’s most successful portfolio management firms, his journey is nothing short of remarkable. This article takes a deep dive into Porinju Veliyath’s net worth, his career achievements, and his contribution to India’s stock market ecosystem.

Porinju Veliyath’s story is not just about numbers or investments; it’s a lesson in resilience and the importance of taking calculated risks. His unique approach to identifying undervalued small-cap and mid-cap stocks has not only yielded tremendous returns for his clients but also inspired countless investors across the nation. But how did he build his wealth, and what is the secret behind his success? Let’s explore every facet of his life, from his early days to his current status as a market icon.

Table of Contents

Early Life and Background

Porinju Veliyath was born on June 6, 1962, in a small village named Chalakudy in the Thrissur district of Kerala. Growing up in a modest household, Porinju witnessed financial struggles firsthand, which deeply influenced his outlook on wealth and success. Despite the odds, his determination to carve out a better life for himself set the foundation for his future accomplishments.

Family and Education

Porinju’s family relied primarily on agriculture, which often meant living on limited means. However, his parents instilled in him the values of hard work and honesty, which became the cornerstone of his character. After completing his basic education in Kerala, he pursued a Bachelor’s degree in Law from the Government Law College, Ernakulam. His decision to study law may seem unrelated to his eventual career in finance, but it provided him with critical analytical and problem-solving skills that later proved invaluable.

Overcoming Financial Challenges

While studying, Porinju took on odd jobs to support himself. These experiences shaped his understanding of financial constraints and taught him to value every rupee he earned. His modest beginnings made him acutely aware of the importance of wealth creation and financial independence, motivating him to explore opportunities beyond traditional career paths.

Porinju Veliyath Entry into the Stock Market

Porinju’s first foray into the stock market was in the early 1990s when he moved to Mumbai in search of better career prospects. His initial years in the city were challenging, but his relentless pursuit of success eventually led him to a job at Kotak Securities, one of the leading financial firms in India. This role was the starting point of his remarkable journey in the world of investing.

First Job as a Floor Trader

At Kotak Securities, Porinju worked as a floor trader, executing buy-and-sell orders for clients. This hands-on experience allowed him to observe market behavior closely and understand the mechanics of stock trading. It was during this time that he developed a keen eye for spotting undervalued stocks and understanding market trends.

Lessons from Early Struggles

Like many newcomers, Porinju faced setbacks in his early investment decisions. However, these failures became valuable learning experiences, teaching him the importance of research, patience, and discipline. His willingness to learn from mistakes and adapt his strategies set the stage for his future success.

The Rise of Equity Intelligence

In 2002, after gaining years of experience in the stock market, Porinju decided to start his own venture. He founded Equity Intelligence, a Kochi-based portfolio management services (PMS) firm. The firm was born out of Porinju’s belief that small and mid-cap stocks held immense untapped potential for wealth creation.

Philosophy and Vision

Equity Intelligence operates on the principles of value investing, a strategy that involves identifying fundamentally strong companies that are undervalued by the market. Porinju’s vision was to create a platform where investors could benefit from his expertise and earn substantial returns by focusing on overlooked opportunities.

Key Milestones

Equity Intelligence quickly gained a reputation for delivering exceptional results. Under Porinju’s leadership, the firm managed portfolios that consistently outperformed market benchmarks. His ability to spot multi bagger stocks companies whose value multiplied several times earned him the trust and admiration of investors.

Porinju Veliyath Net Worth

As of 2024, Porinju Veliyath’s net worth is estimated to be around ₹300 crore (approximately $36 million). This wealth is the result of decades of strategic investing, the success of Equity Intelligence, and other business ventures. His rise to financial prominence is a testament to his deep understanding of market dynamics and his ability to capitalize on opportunities that others might overlook.

Sources of Income

- Stock Investments: A significant portion of Porinju’s wealth comes from his personal stock portfolio, which includes several high-performing small-cap and mid-cap companies.

- Equity Intelligence Earnings: The management fees and profit-sharing from his PMS firm contribute substantially to his income.

- Real Estate and Other Ventures: Porinju has diversified his investments into real estate and startups, ensuring a steady flow of income beyond the stock market.

Net Worth Growth Over the Years

Porinju’s net worth has seen consistent growth, reflecting his ability to adapt to changing market conditions and his knack for picking winning stocks. His investments in sectors like infrastructure, pharmaceuticals, and logistics have played a crucial role in his wealth accumulation.

Investment Philosophy and Strategy

Porinju Veliyath’s investment strategy revolves around value investing, a concept championed by global investment legends like Warren Buffett. However, what sets Porinju apart is his focus on small-cap and mid-cap stocks, a segment often ignored by larger institutional investors.

Core Principles

- Focus on Fundamentals: Porinju believes in investing in companies with robust financial health, competent management, and strong growth potential.

- Contrarian Approach: He often invests in sectors or companies that are out of favor with the market, betting on their long-term turnaround.

- Long-Term Perspective: Patience is a cornerstone of Porinju’s strategy. He advises holding onto quality stocks for years to maximize returns.

Advice for Retail Investors

Porinju emphasizes the importance of doing thorough research and avoiding herd mentality. According to him, retail investors should focus on building a diversified portfolio and not get swayed by short-term market volatility.

Major Investment Success Stories

Porinju Veliyath’s career is dotted with numerous investment successes, many of which have delivered spectacular returns. His knack for identifying hidden gems in the market has cemented his reputation as a visionary investor.

Geojit Financial Services

One of Porinju’s earliest success stories, Geojit Financial Services, turned out to be a multibagger, delivering exceptional returns over time. His decision to invest in this financial services company demonstrated his foresight and confidence in the sector’s growth potential.

Shreyas Shipping and Logistics

Porinju’s investment in Shreyas Shipping highlighted his ability to identify opportunities in niche sectors. The company’s impressive growth trajectory resulted in substantial gains for his portfolio.

Wockhardt

His investment in Wockhardt, a pharmaceutical company, further underscored his belief in the long-term potential of India’s healthcare sector. Despite market fluctuations, his conviction in the company paid off handsomely.

Challenges and Criticisms

Like all successful investors, Porinju Veliyath has faced his share of challenges and criticism. The volatile nature of the stock market has occasionally led to setbacks in his portfolio, drawing scrutiny from peers and media alike.

Market Downturns

Porinju has weathered several market downturns, including the 2008 financial crisis and the COVID-19 pandemic’s economic impact. Despite these challenges, he has consistently demonstrated resilience and adaptability.

Public Criticism

Some of his stock picks have failed to perform as expected, leading to skepticism about his investment approach. However, Porinju’s ability to bounce back and deliver long-term results has silenced many of his critics.

Books Speeches and Media Presence

Porinju Veliyath is not just an investor; he is also a thought leader who has contributed significantly to the discourse around wealth creation and stock market participation in India. His insights, shared through media appearances and public talks, have inspired countless retail investors to explore the stock market as a means to achieve financial independence.

Books and Articles

While Porinju Veliyath hasn’t authored any books, his ideas and strategies have been extensively covered in several investment-related publications. Many blogs, websites, and financial newspapers frequently analyze his investment portfolio, offering market insights into his successful picks. He is often quoted in articles that discuss value investing, his stock selection methodology, and his predictions for the Indian economy.

Speeches and Public Talks

Porinju is a regular speaker at prominent financial summits, including events like:

- Moneycontrol Markets Summit

- CNBC-TV18’s Investor Meets

- ET Now Financial Forums

During these events, Porinju shares his expertise, offering actionable advice to investors. His ability to simplify complex financial concepts has made him a sought-after speaker among novice investors and seasoned professionals alike.

Media Presence

Porinju Veliyath frequently appears on leading business channels such as CNBC-TV18, ET Now, and BloombergQuint. His candid analysis of market trends and his no-nonsense approach to investing resonate with viewers. His interviews often focus on:

- Current market scenarios

- Predictions about economic growth

- Guidance for small-scale investors to navigate volatile markets

Porinju’s strong media presence has made him a household name among India’s investment community.

Porinju Veliyath Contributions to the Financial World

Beyond his personal success, Porinju Veliyath has contributed immensely to the Indian financial ecosystem. His efforts to demystify investing and encourage retail participation in the stock market have played a significant role in broadening the investor base in India.

Educational Initiatives

Porinju has been a vocal advocate for financial literacy. He has conducted multiple seminars and webinars aimed at educating young investors about the principles of value investing and the importance of long-term wealth creation. His goal is to help individuals understand how disciplined investing can transform their financial futures.

Inspiring Retail Investors

One of Porinju’s most significant contributions is his ability to inspire retail investors to explore opportunities beyond traditional saving instruments. He encourages them to:

- Look beyond blue-chip stocks and explore small-cap and mid-cap stocks with growth potential.

- Avoid herd mentality and make informed decisions based on research.

- Stay disciplined and patient, emphasizing that wealth creation is a marathon, not a sprint.

Economic Insights

Porinju regularly provides valuable insights into India’s economic landscape. His commentary on market trends, government policies, and sector-specific growth opportunities is widely respected and followed.

Comparison with Other Indian Investors

The Indian stock market boasts a rich history of legendary investors, each with their unique style and philosophy. Porinju Veliyath’s approach stands out, particularly when compared to other stalwarts in the field.

Rakesh Jhunjhunwala

Often referred to as the “Warren Buffett of India,” Rakesh Jhunjhunwala was known for his investments in blue-chip stocks. Porinju, on the other hand, focuses primarily on small-cap and mid-cap companies. While Rakesh’s strategy often revolved around well-established companies, Porinju has built his fortune by identifying lesser-known businesses with strong growth potential.

Vijay Kedia

Vijay Kedia and Porinju Veliyath share a belief in the power of value investing. However, Kedia tends to focus on companies with proven business models and a track record of profitability, whereas Porinju is willing to take calculated risks on companies that others might overlook.

How Porinju Stands Out

What sets Porinju apart is his contrarian investment approach. He has a knack for spotting undervalued opportunities in sectors that are temporarily out of favor. His ability to turn these opportunities into multi-bagger investments is a testament to his market foresight and confidence in his strategies.

Porinju Veliyath Lifestyle

Despite his wealth and success, Porinju Veliyath remains grounded and true to his roots. His lifestyle reflects a blend of simplicity and elegance, with a strong emphasis on family values and personal well-being.

Family Life

Porinju is married to Lilly Veliyath, and together they have two children. He often credits his family for their unwavering support during his early struggles. His daughter is also involved in the financial world, following in her father’s footsteps.

Real Estate and Assets

While Porinju is not ostentatious about his wealth, he owns a beautiful home in Kochi, Kerala, which serves as both his residence and an office for Equity Intelligence. Additionally, he has investments in prime real estate properties across India, further diversifying his asset portfolio.

Hobbies and Interests

Porinju enjoys reading books on economics and philosophy, which help him sharpen his analytical thinking. He also loves traveling, particularly to explore lesser-known places in India. Maintaining a healthy lifestyle is another priority for Porinju, as he believes that physical and mental well-being are critical to success.

Philanthropy and Social Contributions

Porinju Veliyath strongly believes in giving back to society. His philanthropic initiatives focus on areas like education, healthcare, and community development, reflecting his commitment to uplifting the underprivileged.

Key Charitable Activities

- Education Support: Porinju has funded scholarships for underprivileged students and has supported the establishment of libraries and learning centers in rural Kerala.

- Healthcare Initiatives: He has donated generously to hospitals and medical charities, ensuring better access to healthcare for the economically disadvantaged.

- Community Development: Porinju has actively participated in programs aimed at improving infrastructure and sanitation in his hometown and surrounding areas.

Vision for Social Impact

Porinju’s philanthropy is guided by his vision to create a more equitable society. He believes in empowering individuals through education and opportunities, enabling them to achieve financial independence and contribute to the nation’s growth.

Porinju Veliyath Predictions and Market Outlook

As a seasoned investor, Porinju Veliyath’s market predictions carry significant weight. His insights are based on years of experience and a deep understanding of economic and market dynamics.

Predictions for Key Sectors

- Infrastructure: Porinju sees immense growth potential in India’s infrastructure sector, driven by government initiatives and increasing urbanization.

- Renewable Energy: He believes that renewable energy will play a pivotal role in India’s economic growth, making it a promising area for investment.

- Healthcare and Pharmaceuticals: With rising healthcare needs and innovation in the pharmaceutical sector, Porinju considers this a strong investment avenue.

Advice for Retail Investors

Porinju emphasizes the importance of staying informed and avoiding emotional decision-making. He encourages investors to diversify their portfolios and focus on quality stocks with long-term potential. His golden rule? Invest in what you understand.

Conclusion

Porinju Veliyath’s story is a testament to the power of determination, vision, and calculated risks. From his humble beginnings in a small village in Kerala to becoming one of India’s most celebrated investors, his journey has been nothing short of extraordinary. Through Equity Intelligence, Porinju has not only created wealth for himself and his clients but also inspired a generation of retail investors to explore the stock market.

Porinju’s legacy extends beyond his financial success. His contributions to financial literacy, philanthropy, and stock market education have left an indelible mark on the Indian financial ecosystem. As he continues to make strides in the investing world, Porinju Veliyath remains a beacon of hope and inspiration for those aspiring to achieve greatness through hard work and smart investing.

FAQs

- What is Porinju Veliyath net worth?

As of 2024, Porinju Veliyath’s estimated net worth is approximately ₹300 crore ($36 million). - What is the focus of Equity Intelligence?

Equity Intelligence, Porinju’s portfolio management firm, focuses on value investing in small-cap and mid-cap stocks. - What are some of Porinju Veliyath’s successful investments?

His notable investments include Geojit Financial Services, Shreyas Shipping, and Wockhardt. - What advice does Porinju Veliyath give to new investors?

He advises retail investors to focus on research, patience, and long-term wealth creation rather than short-term speculation. - How does Porinju contribute to society?

Porinju actively engages in philanthropy, supporting education, healthcare, and community development initiatives.